The optimism in the private sector about India’s clean energy prospects a couple of years ago is hard to find now.

Rating agency CRISIL in a recent report said India would not have 100 GW of solar capacity and 60 GW of wind capacity even by 2024, leave alone 2022.

Unfortunately, wind and solar energy developers are running into some of the same problems as their counterparts in thermal power a few years ago, chief among them being outstanding dues from utilities.

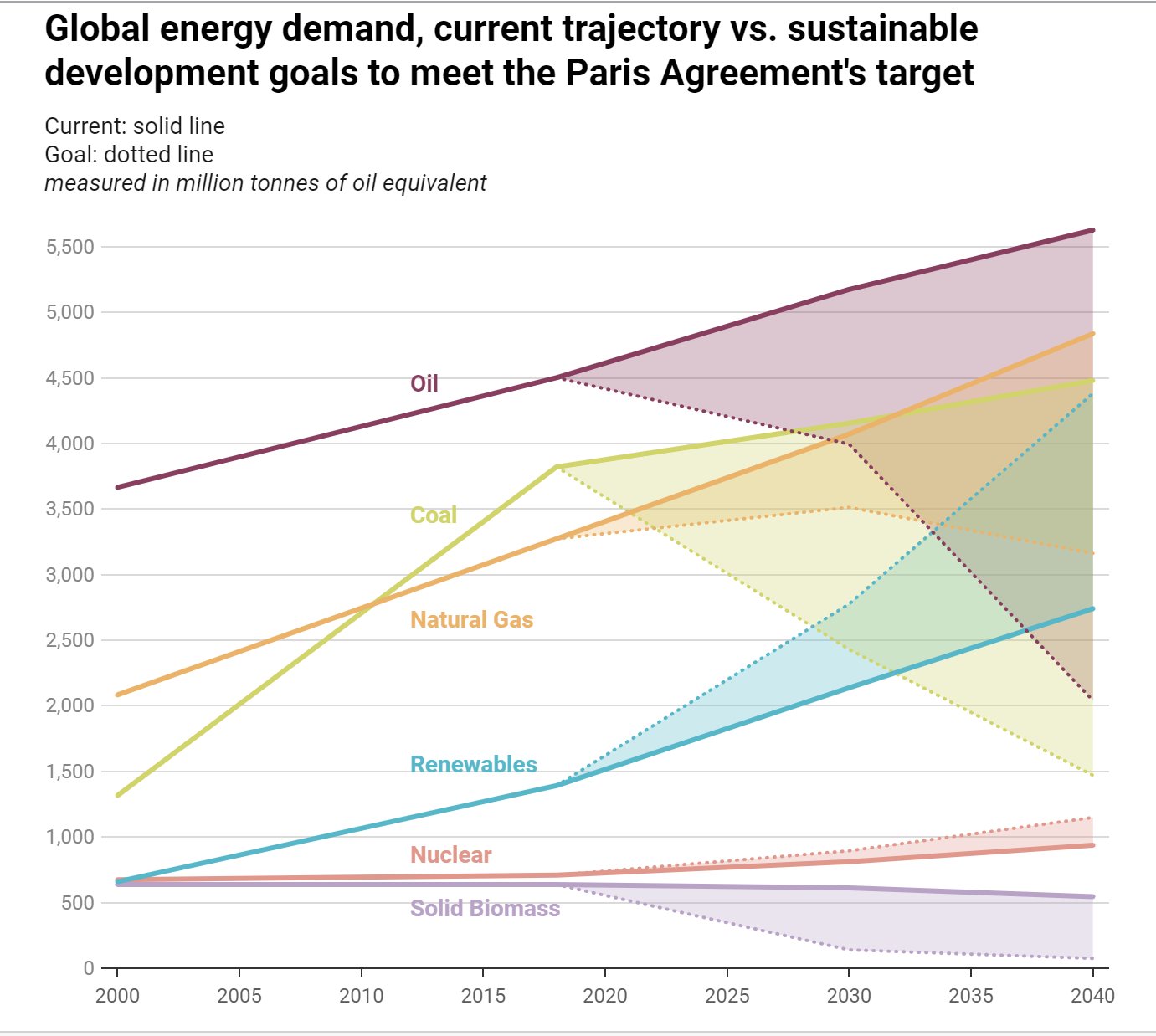

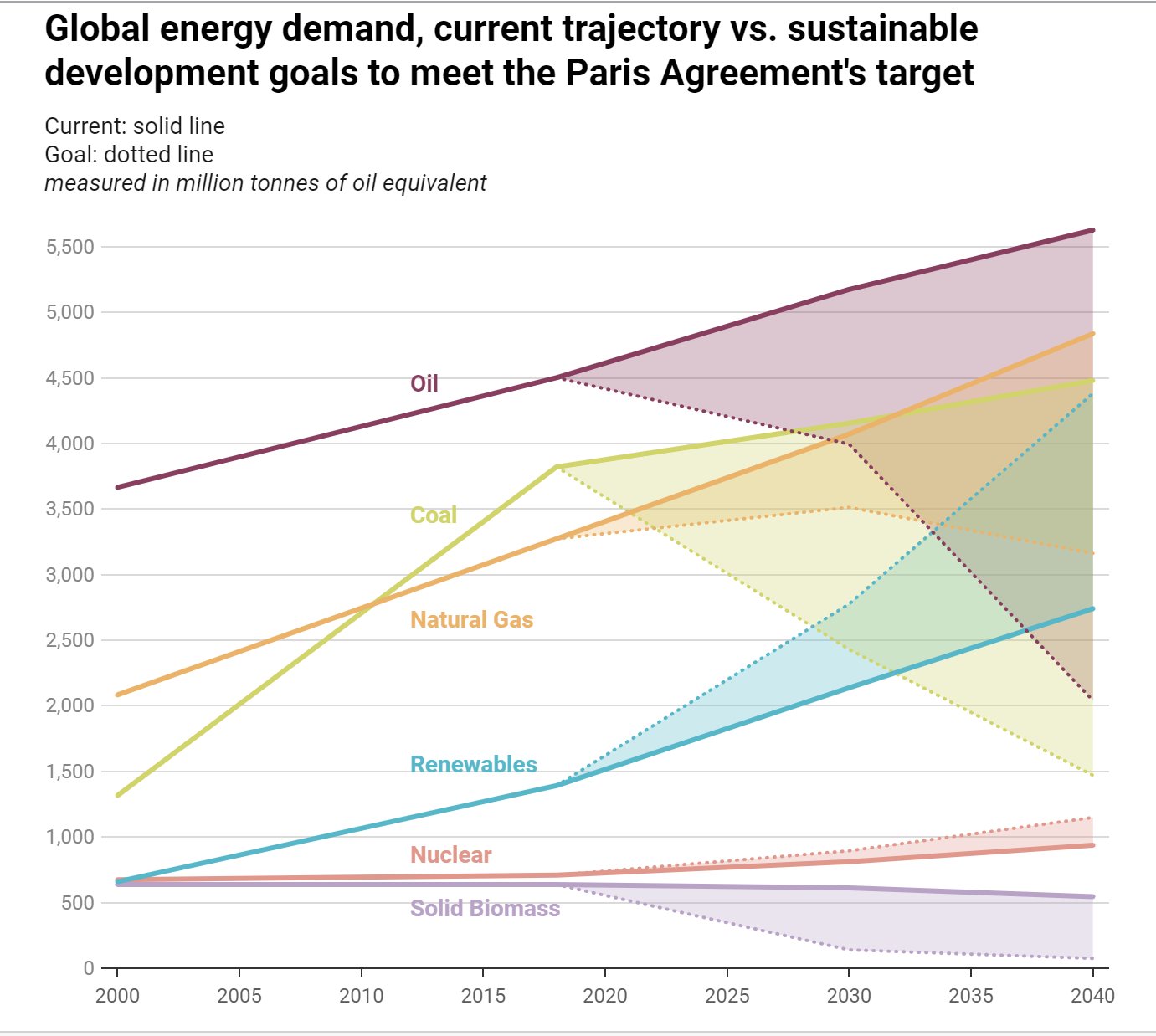

To meet the international Paris Agreement commitments, the world was to have started to sharply decelerate it use of oil and coal in 2018. But that has not happened.

As of July 2019, distribution companies across India owed renewable power producers Rs 9,736 crore, according to CEA data. Around three-quarters of that were owed by four southern states — Andhra Pradesh, Tamil Nadu, Telangana and Karnataka.

Acme Solar Holdings, the country’s largest solar power developer, is waiting for payments totalling Rs 210 crore from Andhra and Rs 386 crore from Telangana. Payments have been delayed between three months and a year.

“We only factor in a delay of 1-2 months,” says Shashi Shekhar, vice-chairman of Acme, “There is a significant loss in return on capital because of these long delays.”

Solar power developers are yet to be compensated for the goods and services tax and safeguard duty on imported cells and modules they paid on projects they won before either of the taxes came into effect.

The CERC has ruled in separate cases that these amount to a change in law and developers have to be compensated for the payments. But companies say they do not know when they will be reimbursed, either as a one-time payment or in the form of increased tariffs.

“I don’t know if some other duty will be imposed tom,” says Acme’s Shekhar. Acme has around Rs 800 C stuck in GST and safeguard duty payments. Because of its liquidity constraints, Acme, which has a portfolio of 5.5 GW, has not bid for any new projects in the past 7 months.If no solution is found to clear the dues from utilities or on the proposed revision of tariffs in Andhra, in addition to making land acquisition easier and easing tariff caps, global investors is likely to look for opportunities in other economies.

That could lead to a consolidation in the industry, and banks and non-banking financial companies will further tighten their purse strings. Then, India’s bold clean energy targets will remain just that.

A May 2020 report said that with no domestic module and cell manufacturing capacity getting added in the renewables sector during the year, the supply of components from China will be critical.

There’s a widening gap between what the research says needs to be done to curb carbon emissions, and what is actually happening. For instance, demand for electric vehicles is growing but so, too, is demand for much larger and much less energy efficient SUVs.

The number of SUVs on the road around the world increased from 35 million in 2010 to over 200 million in 2018, representing 60% of the increase in the global car fleet over the 8-year period, the IEA said.

As the world tries to cut back on carbon emissions, rising temperatures and erratic weather patterns haven’t made it easy. IEA estimated that nearly one-fifth of 2018′s energy demand growth stemmed from hotter summers and colder winters.

Rating agency CRISIL in a recent report said India would not have 100 GW of solar capacity and 60 GW of wind capacity even by 2024, leave alone 2022.

Unfortunately, wind and solar energy developers are running into some of the same problems as their counterparts in thermal power a few years ago, chief among them being outstanding dues from utilities.

To meet the international Paris Agreement commitments, the world was to have started to sharply decelerate it use of oil and coal in 2018. But that has not happened.

As of July 2019, distribution companies across India owed renewable power producers Rs 9,736 crore, according to CEA data. Around three-quarters of that were owed by four southern states — Andhra Pradesh, Tamil Nadu, Telangana and Karnataka.

Acme Solar Holdings, the country’s largest solar power developer, is waiting for payments totalling Rs 210 crore from Andhra and Rs 386 crore from Telangana. Payments have been delayed between three months and a year.

“We only factor in a delay of 1-2 months,” says Shashi Shekhar, vice-chairman of Acme, “There is a significant loss in return on capital because of these long delays.”

Solar power developers are yet to be compensated for the goods and services tax and safeguard duty on imported cells and modules they paid on projects they won before either of the taxes came into effect.

The CERC has ruled in separate cases that these amount to a change in law and developers have to be compensated for the payments. But companies say they do not know when they will be reimbursed, either as a one-time payment or in the form of increased tariffs.

“I don’t know if some other duty will be imposed tom,” says Acme’s Shekhar. Acme has around Rs 800 C stuck in GST and safeguard duty payments. Because of its liquidity constraints, Acme, which has a portfolio of 5.5 GW, has not bid for any new projects in the past 7 months.If no solution is found to clear the dues from utilities or on the proposed revision of tariffs in Andhra, in addition to making land acquisition easier and easing tariff caps, global investors is likely to look for opportunities in other economies.

That could lead to a consolidation in the industry, and banks and non-banking financial companies will further tighten their purse strings. Then, India’s bold clean energy targets will remain just that.

A May 2020 report said that with no domestic module and cell manufacturing capacity getting added in the renewables sector during the year, the supply of components from China will be critical.

There’s a widening gap between what the research says needs to be done to curb carbon emissions, and what is actually happening. For instance, demand for electric vehicles is growing but so, too, is demand for much larger and much less energy efficient SUVs.

The number of SUVs on the road around the world increased from 35 million in 2010 to over 200 million in 2018, representing 60% of the increase in the global car fleet over the 8-year period, the IEA said.

As the world tries to cut back on carbon emissions, rising temperatures and erratic weather patterns haven’t made it easy. IEA estimated that nearly one-fifth of 2018′s energy demand growth stemmed from hotter summers and colder winters.

No comments:

Post a Comment