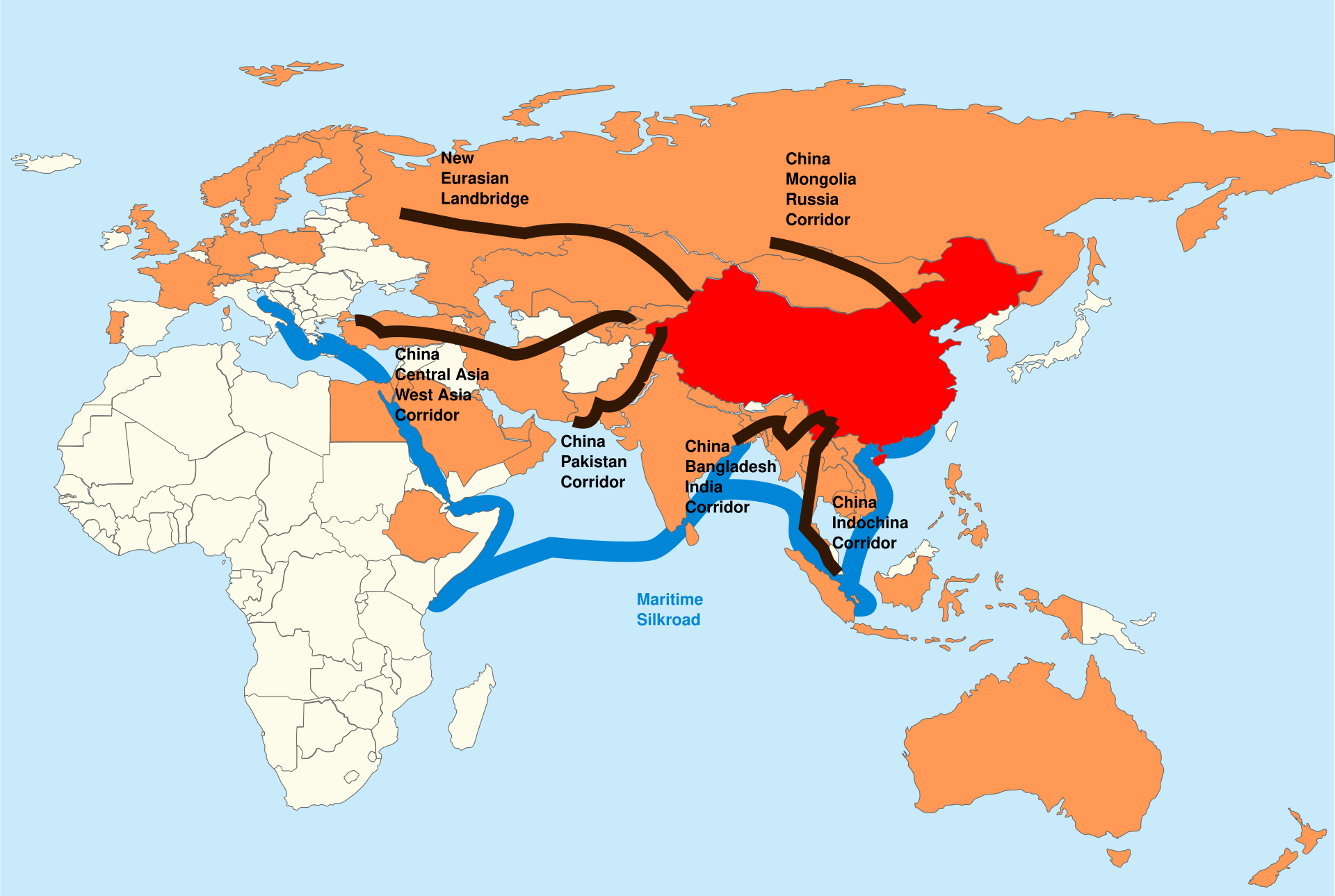

“One Belt” refers to the Silk Road Economic Belt where China plans to invest heavily in infrastructure to underpin its long-term presence in Eurasia. “One Road”, meanwhile, is the 21st century maritime Silk Road which will call for the construction of ports and maritime facilities from the Pacific Ocean to the Baltic Sea.

China Members of the Asian Infrastructure Investment Bank The six Belt and Road corridors Maritime silk road. Image from here.

The initiative serves two key economic objectives for China. First, it creates demand overseas for China’s excess capacity in areas such as steel, cement and aluminium. The number of cross-border co-operation projects envisaged by the Silk Road plan already exceed 900 projects and involve 64 different countries. The total investment value of these projects — most of which are concentrated in the infrastructure sector — is estimated at $890bn.

The initiative serves two key economic objectives for China. First, it creates demand overseas for China’s excess capacity in areas such as steel, cement and aluminium. The number of cross-border co-operation projects envisaged by the Silk Road plan already exceed 900 projects and involve 64 different countries. The total investment value of these projects — most of which are concentrated in the infrastructure sector — is estimated at $890bn.

In 2014, China’s outward direct investment exceeded the foreign direct investment it attracted for the first time.

Beyond South Asia, the other economic corridors which are part of the huge One Belt, One Road plan will have important repercussions for economic growth and infrastructure investment in countries ranging from Mongolia and Russia to the five Central Asian republics of Kazakhstan, Kyrgyzstan, Tajikistan, Uzbekistan and Turkmenistan, as well as in the Middle East and parts of Europe.

The Silk Road project could kick-start a virtuous circle for infrastructure finance across the region by strengthening credit ratings, supporting the evolution of local capital markets and making projects more bankable.

“You only need to visit China and use the high-speed rail system to see that it is starting to lead the world in terms of infrastructure development,” says HSBC’s Dickens. “China is now focused on starting to export some of that technological and construction experience. Be it in high speed rail, nuclear or renewables, China has a lot of knowledge as well as capital to put to work across the world.”

No comments:

Post a Comment